Fuel COVID-19 Consumer Sentiment Study Volume 4: Travelers Are Ready, Especially Millennials

by Melissa Kavanagh

We hope that you find the information useful. The survey was sent out on May 14, 2020, and received more than 7,000 responses. Below is a summary of the findings, along with some observations and opportunities that arise from the results. The previous study can be found here.

Executive Summary

There were very few changes, again, overall compared to the last survey. Below are the highlights:

- Age still matters, but the gap is shrinking.

- Millennials consistently answered that they will be more willing to travel sooner than Gen X and Boomers, and are less risk-averse. However, the confidence is traveling soon has declined slightly since our last study.

- Income still matters.

- Not surprisingly, those in lower income brackets are likely to spend less than they have in the past, with shorter stays, and more affordable properties.

- In this survey, we did find that those in the <$50K bracket were actually more likely to spend their stimulus money on a vacation than other groups.

- Distance matters. We have consistently seen that the 2 hour drive market is likely to recover significantly sooner than further distances.

- Open air is critical. The data clearly shows that less densely populated locations, and those within a few hours drive from home are more likely to be visited within the first 3 months of restrictions being lifted. Outdoor seating at restaurants is more likely to be utilized than indoor seating.

- People WANT to travel. The overwhelming majority of respondents are saying they are still planning a vacation for 2020. Safety is still the top concern, but new words describing their feelings about travel now are about relaxing, being excited and ready.

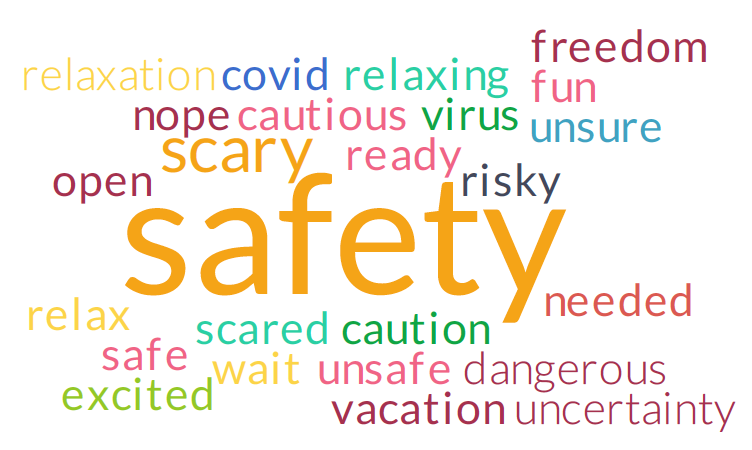

1. What is the first word that you think of when considering travel right now?

- Observation: “Safety” and “scary” were the top words, again. However, scary is growing smaller.

- Data Comparison: New to this set of results is “relax,” “relaxation”, “relaxing,” “excited,” “fun,” and “needed.” “Freedom” has remained in this cloud since last survey. These are clear indications that people are starting to feel the effects of the restrictions of this pandemic. They are feeling the need to get out of the house and are ready for some R&R.

- Opportunity: People will remember how you make them feel during this crisis. People are concerned for their safety above all, but they are also craving relaxation and freedom from their houses. What can you do to ease their mind about traveling to your property?

2. Do you still intend to take a vacation in 2020 or 2021?

- Observation: Only 3% said that they had no desire to take a vacation.

- Data Comparison: Those choosing yes in 2020, has fluctuated between 65% and 62%, and is now back at 65%.

- Income Insight: 4% of <$50K chose no, vs. 3% for $50-$100K, and 2% for >$100K. 69% of >$100K said yes for 2020.

- Geo Insight: 61% of hot spots responded in 2020 (up from 59% last survey), 21% in 2021 (down from 18%). This may indicate that people located in hot spots are feeling slightly more confident about the pandemic passing, but still more likely to wait out the storm before traveling than the average respondent.

- Opportunity: With 65% of consumers saying that they are intending to take a vacation in 2020, along with the fact that many will be ready to book in the next 60 days, it is imperative that you stay top of mind with your prospective guests.

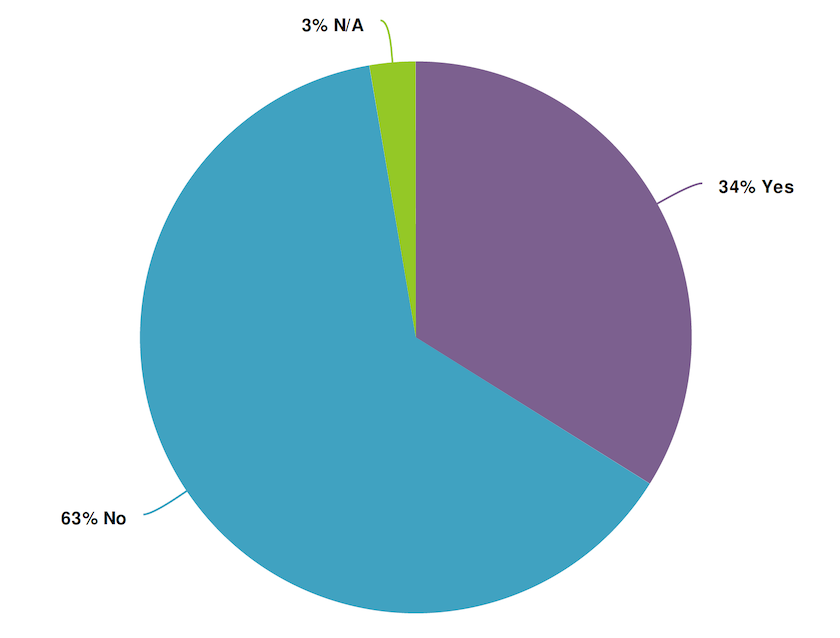

3. Have you already booked your future stay?

- Observation: 34% of people do have an upcoming stay, 62% do not.

- Data Comparison: Those who have not booked yet is starting to shrink.

- Opportunity: Coupling this response with the previous insight shows that people WANT to travel and are feeling the need to get out of their houses. 63% of the population is a lot of untapped opportunity.

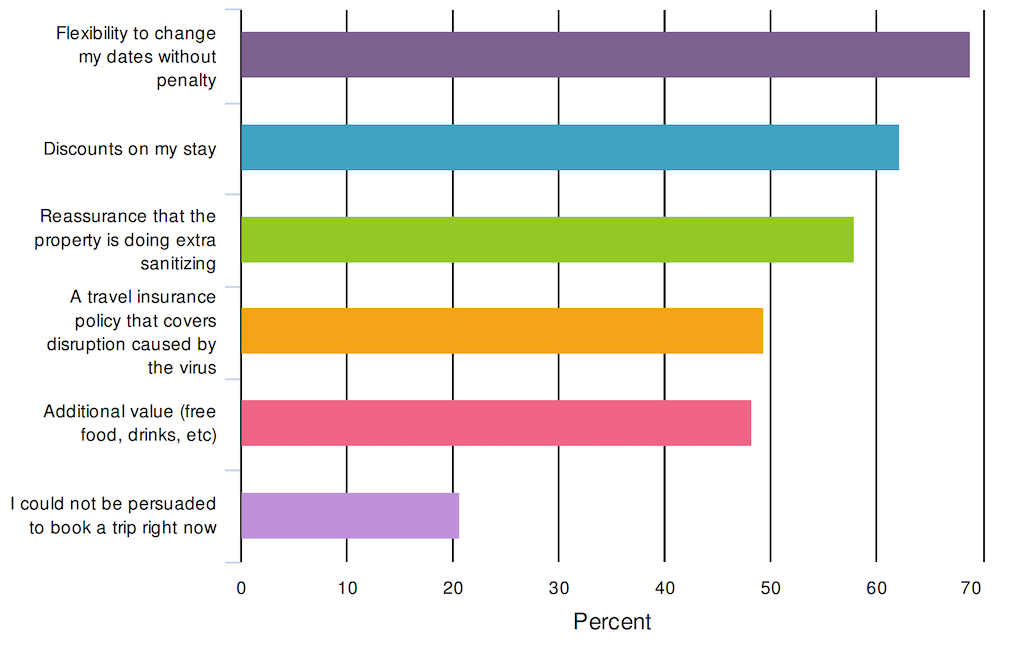

4. Which of the following would most likely persuade you to book a future vacation during the coronavirus outbreak? (Check all that apply)

- Observation: Nearly 70% of people chose flexibility to change without penalty.

- Data Comparison: People saying that they could not be persuaded decreased for the third time, going from 27% to 21%. Flexibility to change increased from 62% to 68%. All other categories have all been moving in a positive direction since the first study.

- Age Insight: While the percentage of Millennials concerned about flexibility remained at 71%, discounts took over the number one spot at 74% . Only 11% could not be persuaded on this round, down from 16% two weeks ago. Boomers who could not be persuaded decreased from 32% to 25%.

- Income Insight: For those in the <$50K category, discounts represented 68% of respondents, slightly outperforming flexibility. We are also seeing a bigger gap in those who could not be persuaded to book now, with 21% in the <$50K, 19% for $50K-$100K, and 15% >$100K.

- Opportunity: Clearly stating your cancellation policy and safety efforts, as well as any changes you have made to it in all marketing efforts is critical.

- Resource: Fuel put this article together on what types of policy changes and messaging you should be implementing right now: The Definitive Guide To COVID19 Policy Updates & Communication

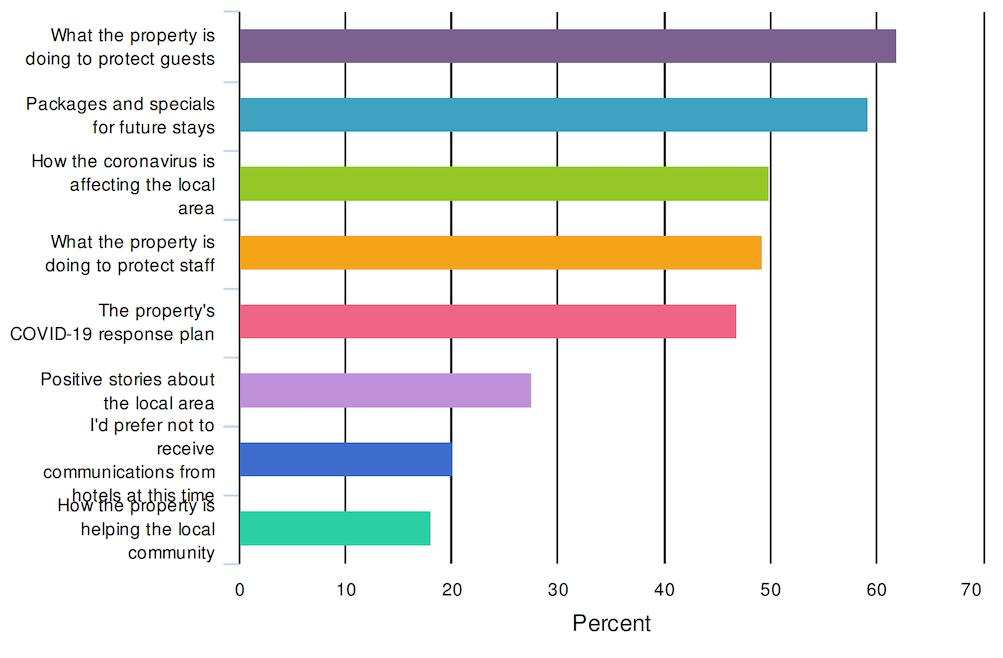

5. During the outbreak, I would like to hear from hotels on the following topics: (check all that apply)

- Observation: Respondents are MORE interested in learning about what properties are doing to protect guests than they are about receiving deals for future stays. They are also interested in safety regarding the staff, what is happening in the local area, and the property’s COVID-19 response plan.

- Opportunity: By proactively messaging your guest database with important information on their safety AND that provides value to them, and shows empathy, you can keep your property top of mind. Being in communication with your guest during this time increases your chances of earning bookings as recovery picks up.

- Data Comparison: Those saying they would not like to hear from hotels now has decreased from 23% to 20%. Those choosing what the property is doing to protect guests increased for the third time, from 58% to 62%. Learning about packages increased from 55% to 58%.

- Resource: Here are some great examples of the types of messages that properties are pushing out right now: Coronavirus: Examples of Hotel Messaging Done Right

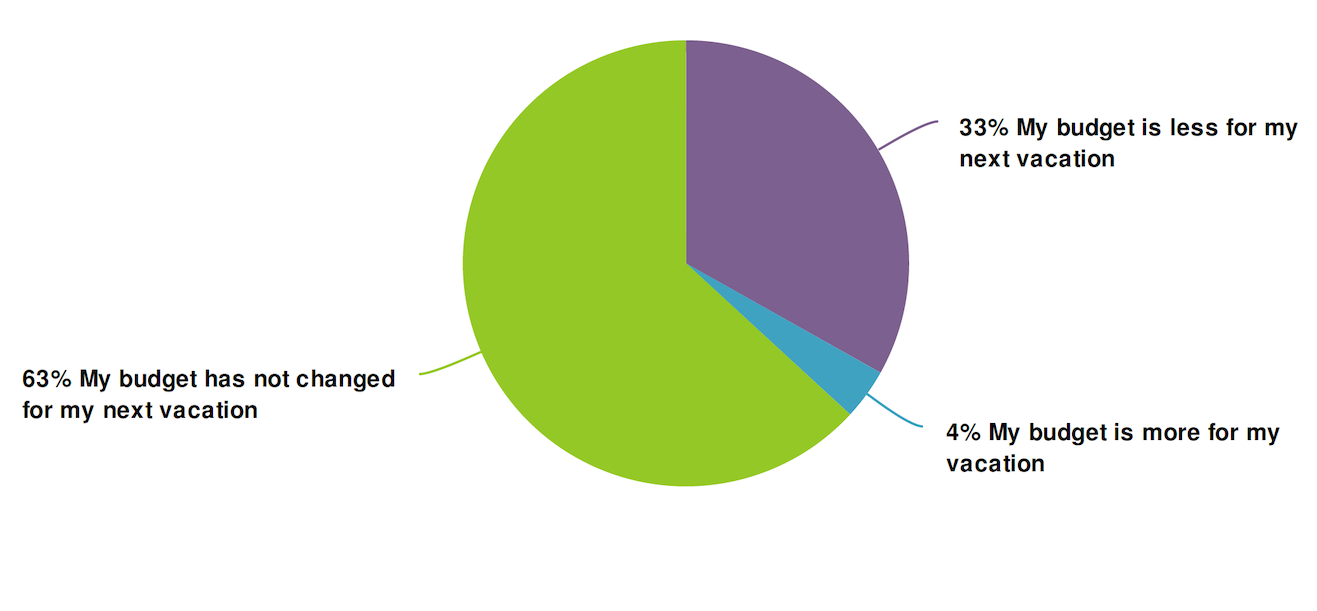

6. As a result of the coronavirus situation, which best describes you?

- Observation: 63% claim that their budget for travel is unchanged, while 33% say that it’s reduced.

- Data Comparison: There is no significant change since last survey.

- Age Insight: In our last survey, 36% of Millennials and Gen X said they would spend less, and 28% of Boomers. On this round, Millennials spending less decreased to 33%, Gen X increased slightly to 37%, and Boomers increased to 31%.

- Income Insight: Only 23% of >$100K said budget will be less. 47% of <$50K will spend less, up from 43% last survey.

- Opportunity: Know your consumer. Younger people, in addition to those in lower income brackets are going to be more price-sensitive. Providing value-added packages will increase the chance of persuading those who are in the more price-sensitive category.

7. How will coronavirus likely affect the length of stay for your next vacation?

- Observation: Less than 30% said that their length of stay would be affected at all. However, most of those that are likely to change their stays, will be staying for a shorter length of time.

- Data Comparison: Data has not changed significantly since the last survey

- Income Insight: Not surprising, more of those in the <$50K category will plan on shorter stays, at 35%, vs. 24% for $50K-100K, and 20% for >$100K.

- Opportunity: By offering both longer and shorter package pricing, you will increase the chance of converting both types of travelers.

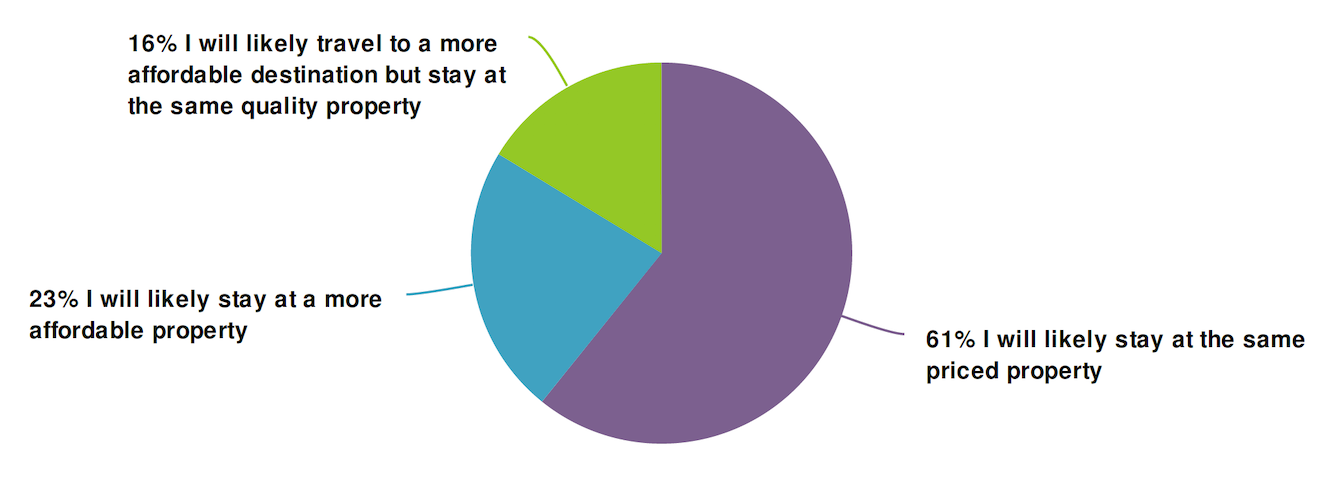

8. How will coronavirus likely affect the type of property you choose for your next vacation?

- Observation: The vast majority of people will likely stay at the same priced property.

- Data Comparison: There is no significant change compared to last survey.

- Income Insight: 34% of <$50K will stay at a more affordable property (up from 29% 2 weeks ago), 14% of >$100K will stay at more affordable property and, and 16% at a more affordable destination.

- Opportunity: Again, any type of added value that can be included in a stay will help persuade these potential guests. Gift cards for gas, 2 breakfasts included per stay, Starbucks gift card or free coffee from your on-site coffee shop are examples of a few low-cost items.

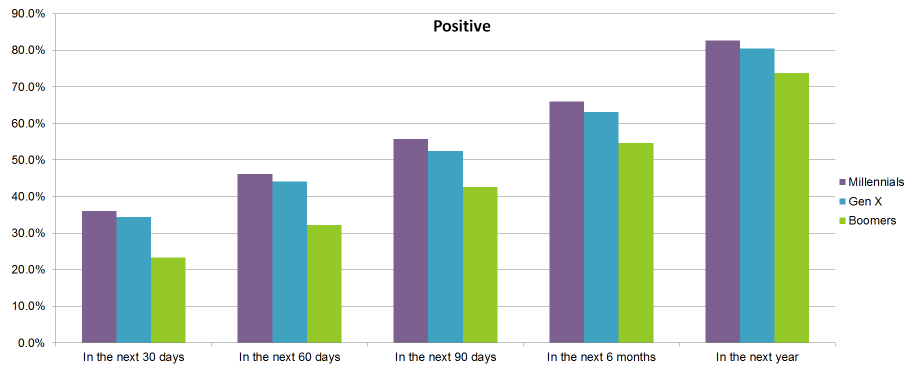

9. How likely are you to book a trip:

Age Insight: Boomers are much more adverse to traveling at all than younger generations, but especially within the next 60 days.

- Observation: There is growing confidence to book a trip in the next 30 days, with 50% responding “maybe” or higher, 65% within 60 days, and 77% within the next 90 days.

- Data Comparison: Those answering at least “maybe” in the next 30 days increased from 43% to 50%. When we first asked this question on April 16, just 37% responded at least maybe.

- Geo Insight: Hot spots answering definitely not within 30 days decreased from 34% to 28%. Those answering likely within 30 days increased from 7.5% to 10.8%, and very likely increased from 8.5% to 11.5%. However, that very likely respondent group is quite a bit lower than the overall group, at 15.5%.

- Looking at the Canadian population, with a caveat that it is a small percentage of respondents, they are very unlikely to travel within the next month or 1-3 months.

10. How soon after the stay-at-home restrictions are lifted in the vacation destination will you be willing to make the following trips?

Age Insight: Millennials are ready to get traveling sooner than older generations. However, their confidence has shrunk compared to the last survey.

Previous survey data appears in the first row of graphs vs. this round on the bottom.

- Observation: For distances of driving up to 2 hours, 64% of consumers will be ready to travel within 3 months of restrictions being lifted. 34% would be willing to travel within 1 month vs. 30% in the 1-3 month window. Staying local and driving up to 6 hours was just under 50% within 3 months, and flying comprised just 20%.

- Data Comparison: The 2 hour drive category saw a very slight decrease in willingness to travel 0-3 months after restrictions are lifted, as did flying.

- Millennials are less likely to travel by a few percentage points within both categories of staying in a local hotel and driving up to 2 hours.

- Income Insight: There is a direct correlation of income to length of time before consumers are willing to travel. 30% of <$50K said they would drive up to 2 hours within 1 month, vs. 36% of $50K-$100K, and 41% $>100K. These differences can be seen across all distances.

- Geo Insight: 21.5% of hot spot respondents said they would stay locally within 1 month, up from 18% on the last survey. They are still more likely to fly than overall population within a year at 61% vs. 54%.

- Opportunity: The 2 hour drive market remains the most confident for traveling sooner rather than later. For the near future, targeting these consumers via email and paid search will yield the best returns.

- Resource: Fuel has developed A How-To Guide For Targeting Drive Markets

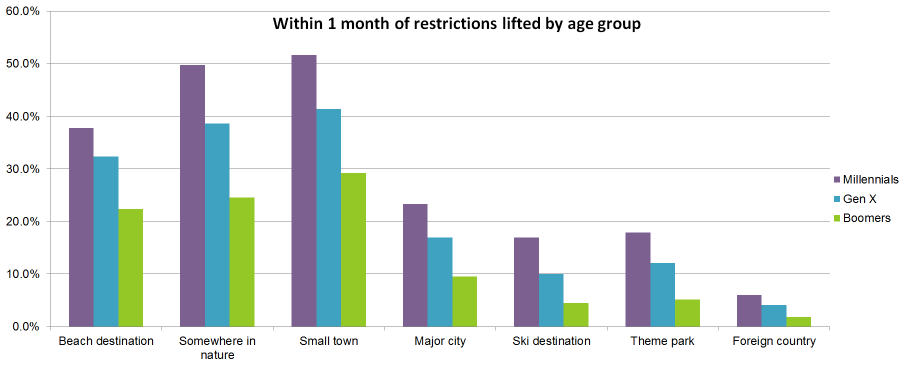

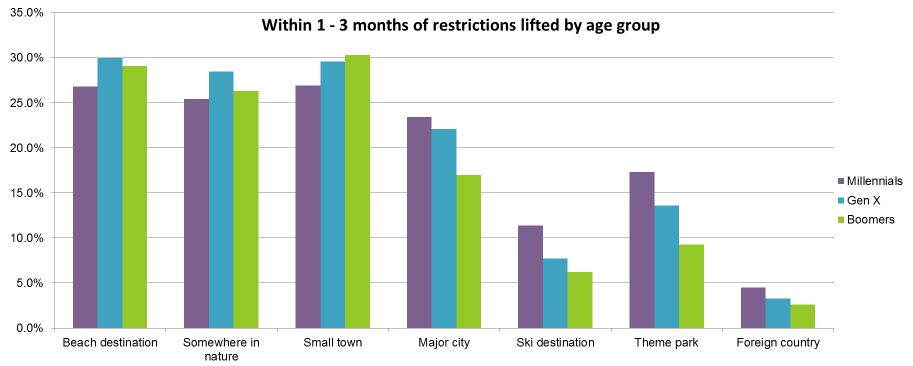

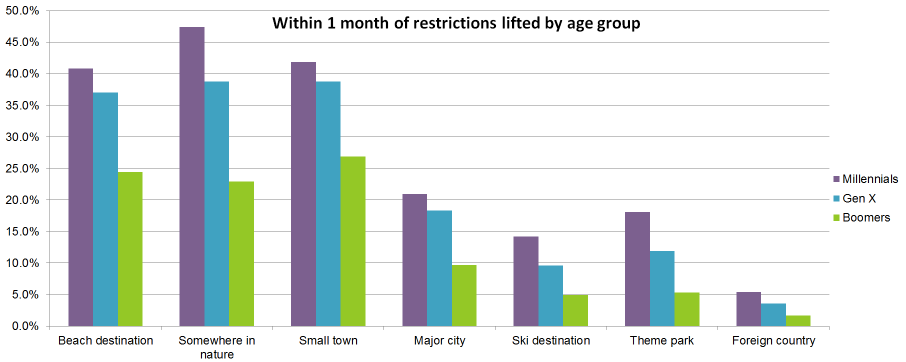

11. How soon after the stay-at-home restrictions are lifted in the vacation destination will you be willing to travel to the following types of destination?

Age Insight: Millennials will be traveling sooner to all types of destinations within 30 days. The gap shrinks for open area spaces in 1-3 months, but is still substantial in densely populated destinations.

- Observation: Destinations with opens spaces are still far more likely to be visited earlier than densely populated areas, or high-touch destinations. Cruise and all-inclusive resort were added as categories on this round. Neither shows interest in the near future.

- Data comparison: Beach destinations increased from 27% to 30% within 1 month. Small towns decreased within 1 month from 36% to 33%. Theme parks have now decreased for the third consecutive time in the 1-3 month category, going from 12% to 11%.

- Geo Insight: Surprisingly, there was little difference for hot spot respondents. We see 1-2 percentage points less than the general population in each destination type within 1 month of restrictions being lifted.

- Opportunity: Open area destinations should expect strong summer bookings. For major cities, even though the numbers are smaller within the first 3 months, it’s still 31% of respondents. Using smart targeting will prove to have the best results.

- Resource: Take a look at your analytics for insight as to what your consumer is looking for vs. booking. What COVID-19 Means for Your Analytics Data

12. During your next vacation how likely are you to do the following?

- Observation: Consumers are, by far, least likely to order room service. Eating on property and at local restaurants OUTSIDE were far more likely than eating at those places inside.

- Age Insight: All age groups were less likely to eat inside than outside at either type of restaurant.

- Room service was one category that showed a large discrepancy. Millennials said likely or definitely at 33%, vs. 26% for Gen X, and 19% for Boomers.

- Gen Xers were most likely to buy groceries for the room, with 47% saying Likely, vs. 41% for Millennials and 43% of Boomers.

- Boomers were far less likely to order delivery to eat in the room, with 43% saying Likely or Definitely, vs. 65% for Millennials, and 57% for Gen X.

- Opportunity: If you have an on-property restaurant, promoting outdoor seating will be a large benefit. With consumers being slightly MORE likely to buy groceries to eat in their rooms, properties that have rooms with kitchens have a huge advantage. Showcasing those kitchens is imperative now.

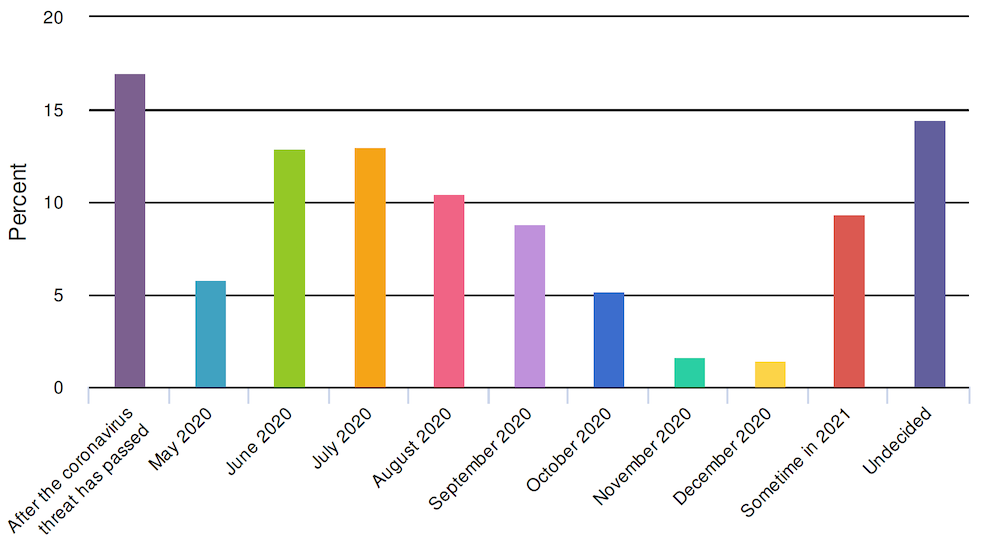

13. When do you intend to BOOK your future vacation? & When do you intend to TRAVEL for your future vacation?

BOOK

TRAVEL

- Observation: For booking, 18% said after the virus has passed, 19% were undecided. Sometime in 2021 was chosen by 8%. Of those that chose a 2020 date, June was most popular, at 11%, followed by May at 11%.

- For traveling, 14% were undecided. June and July were the most popular answer of those that chose a date, at 13% each.

- Data Comparison: For booking, “after the threat has passed” responses shrunk again from 23% to 18%, with May, June and July picking up the most traction. For travel, this response also decreased dramatically from 21% to 16%.

- Geo Insight: For booking, hot spots responded with 21% after virus has passed, down from 28% last survey, and compared to 18% overall.

- Opportunity: The continued decrease in those choosing to not make a decision until after the virus has passed indicates there is increased confidence that the pandemic is passing. Sending clear messaging about your property’s cancellation policies and safety procedures can help consumers be persuaded to book.

- Resource: We’ve put together a crisis recovery checklist to help guide you.

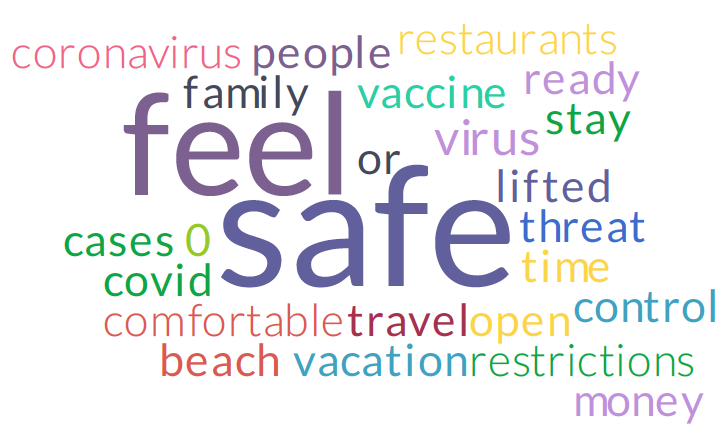

14. Complete the following sentence: I will travel when:

- Observation: Safety is most prevalent since we first asked this question. Words having to do with being open or restrictions lifted have also been popular.

- Data Comparison: “Restaurants” was a new response last time. This time we can see “beach.” This is an indication that fear is beginning to decrease and people are beginning to prioritize other factors.

- Opportunity: As mentioned before, whatever you can do to assure visitors that you have their well-being as a priority will increase your chance in convincing them to stay with you. Messaging around your restaurant should be included in your list. Being cognizant of the financial stress many people are feeling, and providing value-add items to packages where possible will help consumers feel more comfortable booking.

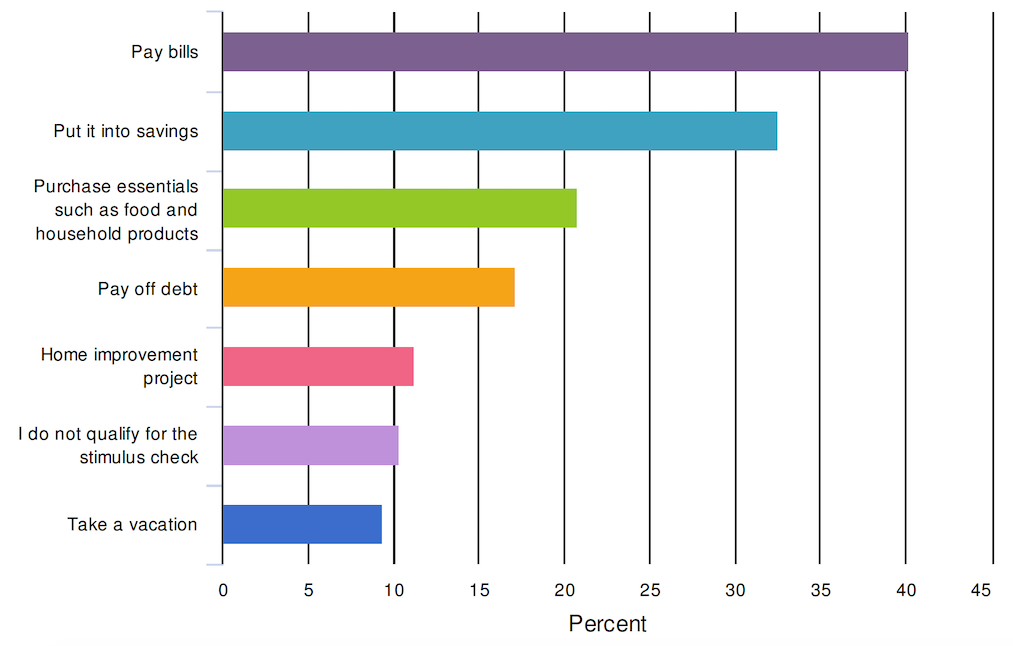

15. The government is sending every American a stimulus check to help during the coronavirus crisis. How do you intend to spend your stimulus check?

- Observation: Very few people (<10%) are considering spending their stimulus check on travel at this time. The majority of people are looking at paying bills (40%), putting it into savings (32%), or buying essentials (21%).

- Data Comparison: Data has fluctuated back and forth a few percentage points for several options, but nothing substantial. For this instance of the survey we added a few more options, including ‘buying a vehicle’, and ‘buying non-essential products (such as electronics or jewelry’. With the exception of ‘Home Improvements’, none of these new selections received more than 1% of the responses.

- Income Insight: Interestingly, more than 10% of the <$50K group said they would take a vacation, compared to 8% for the other groups. This may be due to the additional income being received from government relief initiatives.

- Opportunity: Many people are feeling the financial strain from this pandemic, with unemployment filings reaching astronomical levels for the last few weeks. Keeping in mind that money will be tight for people for some time, there should be a focus on adding value to your packages. Look at incorporating things like free upgrades and food and beverage credits to encourage people to stay with you and help their pennies stretch further.

Wrapping it Up

For the second consecutive round of survey data, very little has changed. Slowly, but surely, people are feeling more comfortable about traveling. Loosened cancellation policies that are well-promoted and clearly stated will be the key to getting more bookings. Older generations are still more skeptical of traveling in the near future. Lower income families are continuing to see a strain on their budgets and will likely book shorter and more affordable properties.

In the meantime, check out our COVID-19 and crisis management resources here.

Survey Methodology

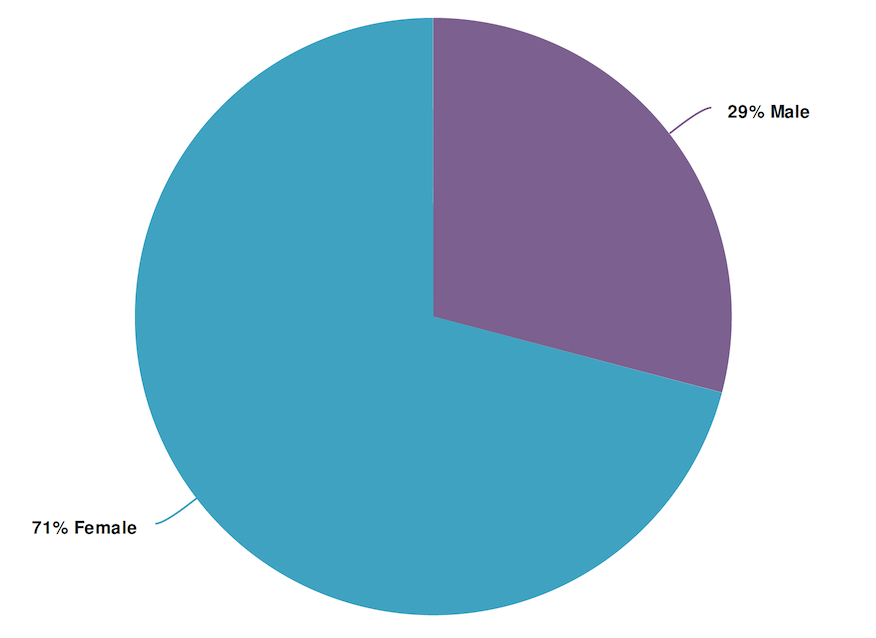

This was a self-reporting survey sent to a database of leisure travelers located in North America. Questions containing multiple checkbox responses had the options randomized to avoid positional bias. Over 5,200 respondents completed all questions. Below are the demographic breakdown of respondents.

Age & Gender:

Do you have children living at home with you?

What was your total estimated household income before taxes during the past

12 months?